Contents:

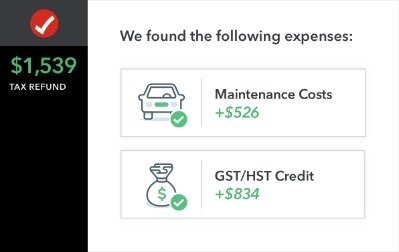

If times are tight and money must be found somewhere in order to pay a crucial bill, advertise, or otherwise capitalize on an opportunity, consider cost-cutting. Specifically, take a look at items that can be controlled to a large degree. Another tip is to wait to make purchases until the start of a new billing cycle or to take full advantage of payment terms offered by suppliers and any creditors. Some thoughtful maneuvering here could provide the business owner with much-needed breathing and expansion room. To create a budget, check industry standards to determine the average costs of doing business and create a spreadsheet estimating the amount of money you’ll need to allocate toward your costs.

Creating a business budget can transform how your company handles money. It can open new doors and allow you to eliminate financial drains on your operation. And once you’re experienced, it doesn’t take much time to keep updated. Following a small business budget is non-negotiable, just as many people believe should be the case with a personal budget. Regardless of how you manage your money away from work, a business budget is essential because it increases financial responsibility. A budget calculator can help you see exactly where you stand when it comes to your business budget planning.

If your morning coffee and muffin comes to $5.01, give them $6.00 and drop the .99 into a jar. With little planning and regular monitoring, you can plan for the future of your business. This template is especially useful for small companies that are reporting budgets to clients and for in-house teams getting buy-in for complex projects.

Free Tools

Similarly, you can also calculate the variances by automated calculators integrated into the templates or budgeting software. In short, it is an all-in-one software that will cover all finance-related requirements of your business in addition to budgeting. This example can be treated as a small business budget sample when you’re preparing your business budget. After estimations, it’s time to allocate a budget to each department based on the estimated values.

Start by analyzing all the previous revenue acquired and the various sources this revenue comes from. Historically, small business owners have good odds in the initial launch of a new company. Roughly 80% of small businesses with employees will survive their first year, according to data from Fundera. These formats will help you determine how much revenue you need to cover costs and make a profit so you can pay yourself, and how much, if any, cash you will need to fund cash shortfalls. Bank of America, N.A., Merrill, their affiliates and advisors do not provide legal, tax or accounting advice.

Whitmer Statement on Strong Monthly Jobs Report – Michigan Courts

Whitmer Statement on Strong Monthly Jobs Report.

Posted: Thu, 20 Apr 2023 07:00:00 GMT [source]

Let’s take a look at how to create a small business budget in five simple, straightforward steps. On one side of the sheet are the value of your assets, cash you have in the bank and existing invoices that haven’t been paid by clients yet. On the other are any taxes that are due, business debts or loans you have and expenses that you haven’t paid yet. The budget won’t be accurate if you forget to include specific bills, taxes or payments. Xero lets you easily create a budget using their Budget Manager feature.

What makes a good budget?

Find out what your small business budget should include and learn how to prepare an annual budget for a company. Then use our free business budget template to create a budget of your own. There are many free templates, open-source software, and applications for budgeting.

Consolidate them to have an estimate of total revenues for the next financial period. Budgets enable a business to accurately set goals, priorities, and spending caps, and detail where funding originates and where new strategies might bring revenue into the company coffers. The line items that command the most funding are high-priority items like the sources of revenue and the different types of expenses. These items demand precise bookkeeping and serve as performance indicators of the overall business strategy.

In the first year of business, most businesses don’t make any money—many require roughly 18 to 24 months to reach profitability, according to Forbes. Businesses may learn the most from these losses that there is likely room to cut unnecessary spending. Rather than waiting for something to go sideways and then reacting, set aside extra cash for contingencies within the budget. Using this surplus on other business costs will be tempting, but this money is an emergency fund. In any case, 2020’s financial results aren’t going to look like those from last year.

Get the Picture: Sample Small Business Budget

Once you have tracked your expenses and analysed the income and expenditure for each category, it is time to adjust your budgeting goals. You may find that some of your monthly estimates or costs are higher or lower than expected. Setting goals is an important first step in budgeting for small business owners. Goals will help determine the budget that needs to be set and monitored, as well as provide direction and focus when creating a plan. Small business budgeting is crucial to the success of your business.

Create your budget using the numbers from historical profit and loss statements. Your income and expenses may grow or shrink over time, so it is important to calculate an average or to add a buffer to your expenses. Your budget should always have money left over for incidentals, as well as allocation to an emergency fund. “Variable costs are those that change from month to month depending on your company’s success, consumption-based utilities, delivery charges, transport costs, and sales commissions. When your earnings are greater, you may spend more on variable costs, but when your earnings are lower, you should aim to cut back where you can,” says Hudson. Use a small business budget template or spreadsheet to itemize and add up your income.

Small business budgets for different types of company

Click here to read our full review for free and apply in just 2 minutes. Like Xero, Zoho Books lets you enter budget numbers for a single period, then specify a percentage increase or decrease in budgeted numbers. Before completing your budget, you might want to consider your long-term goals. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. You’ve just purchased or opened a small business and you know your trade. But when it comes to bookkeeping—and more specifically, budgeting—your skill set is lacking.

Income taxes are a variable expense, and you don’t know what taxes you will have to pay until you calculate your net income. Don’t include taxes in fixed expenses or variable expenses but make these a separate category. Add monthly variable costs to monthly fixed costs to get total monthly costs . A perfect budget evaluates previous years’ data and draws realistic projections.

On the flip side, owners may realize that in order to have three employees instead of two, the business will have to generate more in revenue each week. Every small business owner tends to have a slightly different process, situation, or way of budgeting. However, there are some parameters found in nearly every budget that you can employ. LocaliQ’s Complete Guide to Marketing Budgets not only provides you with a marketing budget template, but also walks you through the marketing budget basics. It helps keep the doors open in case of a recession, off month, a downturn, slow payments, and delayed checks. Know whether you need to cut expenses or increase revenue to achieve your strategic, operational, and financial goals.

Best Free Project Management Budget Templates for Marketers

The beauty of budgeting is that it forces you to think about different scenarios and lets you create contingency plans. In the end, budgeting for business is much like budgeting for your household; you have to know how much money is coming in, where it goes, and what you want to do with the excess. If exchanging your goods or services for an item that you were budgeting for is an option, do it. Bartering is an age-old way to get things done, and for good reason; it’s a win for both parties. It’s all about who you know, so don’t be afraid to make use of the relationships you’ve fostered. Go through your networking list and search for ways to reduce the cost of items or services you are looking for.

Your goal should be 3–6 months’ worth of operating expenses—and don’t touch it unless you’re dealing with an actual emergency. US, Canada, and UK access.Reporting With over 20 built-in reports, you’ll know exactly how your business is doing. The answer is ‘it depends.’ Your marketing budget is always a specific percentage of your revenues. Suppose you’re running a small business targeting B2B customers, your marketing budget can be between 2 to 5% of the revenue. There is no absolute value of how much a small business budget should be.

- You generally will have more control and discretion when it comes to variable expenses.

- You can also plan to offer different services during the off-season.

- Sifting through financial records to pull the data you need can be a chore.

Be generous with your products, services and profits along the way. Constantly live out a spirit of generosity and encourage it in your team. That’s the hallmark of people who live successful lives and who operate business with soul. If your business has been making money for a while, use your P&L statements to look back and project what you’ll expect to make month over month. And if you’re just starting out, you’ll have to make an educated guess about what you think you’ll earn in the upcoming month. If you’re a small-business owner, you know firsthand that every penny counts.

You can easily spot if you’re going over budget midway through a project so you can adjust. This free bundle includes eight different templates, so you can create multiple budgets to help you determine how much money to put toward marketing, plus the return on your investment. Without one, you could easily be drowning in expenses or unexpected costs. With regular budget tracking, you always know how your business is doing.

Get the final budget approved and implement it in the future. For instance, in a manufacturing business, raw material is a variable cost. They will only purchase raw materials when manufacturing is done.

Service businesses

You can also create multiple budgets, some short-term and some long-term. During this stage, you will also set spending limits and create a system to regularly monitor the budget. Your fixed costs won’t change month to month, so they are the easiest to subtract from your income. Fixed costs might include rent, salaried employees, and non-variable utilities. Automating payments wherever possible is an excellent way of ensuring that your small business budget remains within the allocated limits.

Problems That Can Kill a Small Business – Business News Daily

Problems That Can Kill a Small Business.

Posted: Fri, 14 Apr 2023 18:08:59 GMT [source]

The fourth and final california income tax rate to creating a budget for your small business is to take your calculations of net income and use them in actively setting financial goals. This is a crucial step, whether your business is “in the red” or “in the black” currently. You can create your own in-house reusable business budget template by following the step-by-step guide we’ve shared above. Besides, you can also use a business budget template as a reference and modify it according to your unique business needs.

You can copy budget details from actuals for the prior year, copy data from an existing budget, or create a new budget from scratch. Adjustments can be made for each budget period, so you can adjust the amount each month to increase budgeted totals by a set amount or by percentage. One of the easiest and most accurate ways to create a budget is to review your revenue and costs for the past year and use those numbers when creating your new budget. By creating, and more importantly, following a budget, you can eliminate wasteful spending, develop plans to expand your revenue base, and work toward your set goals in a productive fashion. Factoring in one-time expenses is one of the perks of keeping a business budget. You can budget for different upcoming obligations to make them less of a financial burden.

Comentarios recientes